MICHAEL S. GAWEL, CPA, JD

My name is Michael S. Gawel and I have been a Certified Public Accountant since 1980. I have a BBA in Accounting and a JD from SUNY @ Buffalo School of Law. I am going to write a weekly tax advice column for the Niagara Falls Reporter geared towards the residents of Niagara Falls on Federal and New York State tax issues. I am also going to take email questions from readers and answer those each week.

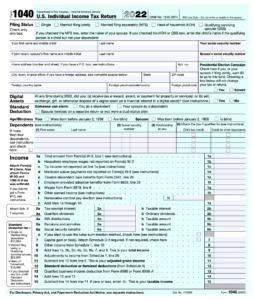

Who should File Form 1040?

Form 1040 is due April 15 of the following year with an extension available until October 15, if timely filed. The IRS can go back as many years that they want if you were required to file.

People who should file include anyone who is getting a refund including children and seniors. Anyone eligible for child tax credits, earned income credits, tuition credits and all other Federal and State Credits. Individuals who have a loss from their business should file so they can carry that loss forward or back. Taxpayers who start a business and purchase assets but don’t have any sales should place the assets in use and take any allowable depreciation. This is especially important in cities like Niagara Falls where individuals purchase buildings and then fix them up before they are ready for use or rental. You need to set the basis of the asset on the depreciation schedule and properly record all additions and improvements to the asset.

Another item that would require filing a tax return is gambling winnings. If a 1099-G is issued by the Casino or NYS you are required to file. You are also allowed to deduct your gambling losses against these gambling winnings.

So when in doubt- file. You might get a refund or receive a credit you can carry forward.

Who must File Form 1040?

Any US Citizen of or resident alien who has gross income in 2022 of:

Single: $12,950.00

Married Filing Separately: $5.00

Married Filing Jointly: $25,900.00

Or has unearned income for 2022 or: $1,150.00, earned income over $12,950.00 or has alternative minimum tax, taxes on a qualified retirement plan, taxes on tip income, taxes on a HSA, net earnings from self employment of at least $400.00, or the recapture of various tax credits.

There are other items that require the filing of income tax returns, some tax related and some not. Offer in compromise agreements, family court, probation agreements, and bank loan agreements, some license applications like Cannabis Retail License, some VISA statuses and others.