While the City of Niagara Falls has stalled a proposed Data Center with a $1.5 billion investment by Urbacon, one of the world’s largest data center developers, and NFR, the city’s largest landowner, other areas in the country, are seeing the need and taking advantage of the AI boom.

Another significant data center developer in Santa Clara, California, Vantage Data Centers, received a significant boost in its operations with a $6.4 billion equity infusion. This substantial investment is a clear indicator of the thriving sector, propelled by the rapid rise of artificial intelligence technologies.

DigitalBridge Group, a prominent digital infrastructure investor, and Silver Lake, a leading technology investment firm, are providing the capital infusion. With this investment, Vantage Data Centers aims to expand its capacity by over 3 gigawatts globally, sufficient to power more than 2.5 million homes. This expansion is a strategic move to meet the escalating demand for AI services from tech giants like Microsoft, Google, Oracle, and Amazon Web Services. According to company officials, the expansion will cost around $30 billion, including debt.

Sureel Choksi, CEO of Vantage, highlighted the pace at which AI has been adopted in the business technology sector, sparking a competitive race among the world’s leading tech companies. The $6.4 billion equity raise has propelled Vantage’s global valuation to an impressive $15 billion.

The data-center industry, essential for housing the internet, has seen a surge in demand, mainly as AI computing, like OpenAI’s ChatGPT, requires significantly more power and cooling resources than other technologies. Before the AI boom, data center deals typically involved capacities ranging from 20 to 50 megawatts. However, Vantage has witnessed deals with tenants seeking 100 to 500 megawatts specifically for AI applications in the past year, Choksi noted.

According to datacenterHawk, a data, research, and consulting firm, North America leased 2.4 gigawatts of data-center capacity in the first three quarters of 2023, likely to reach or surpass 3 gigawatts by year-end. This figure marks a significant increase from 2.3 gigawatts in 2022 to just 1 gigawatt in 2021.

David Guarino, an analyst at Green Street, a real estate analytics firm, reported that data-center rents rose in the low double digits last year, outpacing the high single-digit increases of 2022. Data center operators anticipate the market will remain robust through 2024.

The flourishing data-center market starkly contrasts other commercial-property sectors, which are grappling with declining valuations due to high interest rates and sector-specific challenges like remote work and online shopping. Despite similar challenges, the data center industry has offset these with higher rents.

Major investment firms, including Blackstone and PGIM Real Estate, have participated in the data center boom. Real estate investment trusts focusing on data centers saw a 30% rise in shares in 2023, outperforming the industry average of about 10%, as reported by Green Street.

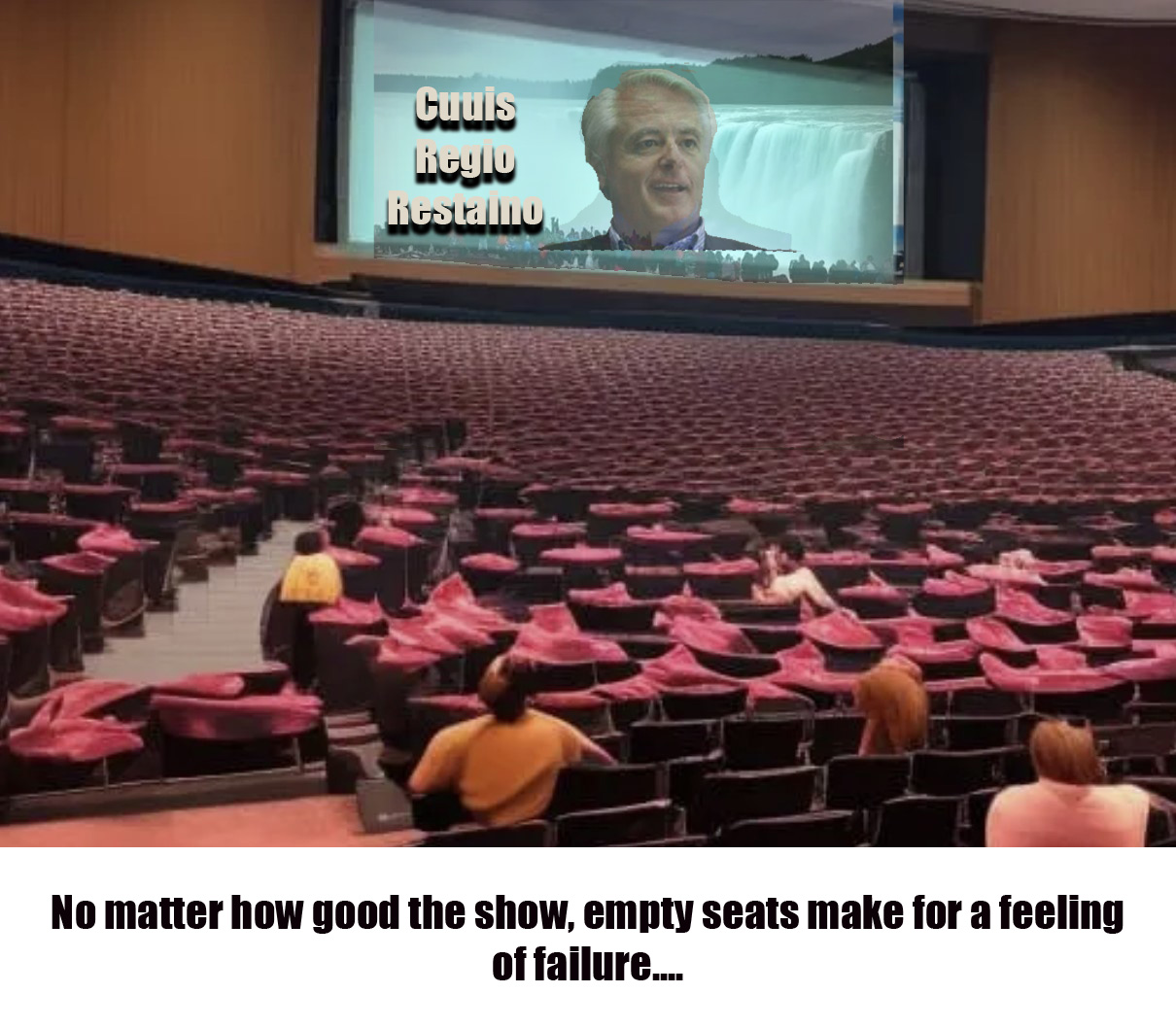

Only one place in America today has yet to welcome the expansion into data centers. That is Niagara Falls, NY.

For some inexplicable reason, the mayor sought to seize 10 acres through the eminent domain of the planned 70-acre Niagara Falls Data Center for an events center.

Gov. Kathy Hochul urged Restaino to work towards allowing the data center, with its 550 new high-paying jobs and no public funding, to use an alternate site for his planned events center, which relies on $200 million in public financing, which is not in the state budget this year or unlikely for next year.