Mayor Paul Dyster has led Niagara Falls to the most precipitous and disastrous decline in the city’s history. And it wasn’t easy.

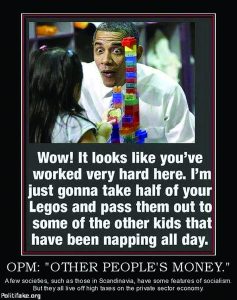

If there’s one thing Niagara Falls Mayor Paul Dyster can’t get enough of, it’s money. And not money like you work for, Dyster wants other people’s money.

Those who contribute to his campaign war chest are routinely rewarded with valuable city real estate, consulting contracts and city jobs. He’s blown through nearly $200 million in revenue from the Seneca Niagara Casino and Resort during his eight and one half years in office and has done everything in his power to ensure that his Niagara Falls is the highest taxed municipality in the highest taxed state in the nation.

Now he’s angling for a $5 million grant from the state Financial Restructuring Board for Local Governments, but he may find he’s getting more than he bargained for.

The board accepted the city’s plea for assistance, in part due to the fact that the tax rate here – which averages $20.14 for every $1,000 in value – is the highest in the state.

And even with that, Dyster managed to run up a $12.5 million budget deficit last year that required the city to plug the hole using casino cash, which is only supposed to be used for economic development projects.

Longtime city Comptroller Maria Brown warned against such irresponsible spending habits so Dyster fired her.

He’s been trying to get the state to step in for three years, but the city Council twice shot the proposal down. So Dyster and Council Chairman Craig Touma created a local Financial Advisory Panel to recommend what he wanted in the first place. The panel released its report late last year, recommending that the state be called in, and the Council was swayed.

Dyster called the state run board’s June resolution accepting Niagara Falls into its program a “positive development,” and representatives from the board are expected to begin poking around in this city this month.

The board will grant a municipality up to $5 million, but only if the local government accepts its recommendations. For Dyster, that could get a bit tricky.

Would any responsible financial advisor permit the wanton use of casino cash to plug holes in a totally out of control general budget, for example?

The state board, created by Gov. Andrew Cuomo, features a 10-member review committee that makes budget cutting recommendations for cities, towns, villages and counties that enter the program.

“You’ve got the panel with experts and expert staff behind them looking at a lot of cities and I think that comparative analysis would be helpful,” Dyster said.

The mayor has been seeking, and the Council recently approved, a citywide reassessment that will result in real tax increases here of between 17 and 40 percent, depending on what part of town you own property in.

“It’s been a long time since the city has had a reassessment,” the mayor said. “It seems that we are getting to the point where a reassessment needs to be done.”

The last time the city attempted a reassessment was in 2004, but it was never completed. Howls from politically connected property owners in LaSalle brought a halt to the program.

Homes and businesses in the city are currently assessed at between 60 and 83 percent of their purported value. Niagara Falls, according to the city’s most recent budget reports, presently list residential property at $876.5 million value and its commercial property at $398.4 million value.

In other words, the reassessment will result in tax assessments spiking on average from between 17 and 40 percent.

Dyster has raised taxes repeatedly over the past nine years, but the $28 million or $29 million derived from property tax revenue has remained static.

The reason? People are just walking away.

The mayor himself pointed out that, between 2010 through last year, the city’s property tax revenues remained relatively stagnant, rising only about 8 percent over that time, well below the rate of inflation, and despite his numerous tax increases.

City services and economic opportunity in Niagara Falls are such that the city has among the highest rates of crime, unemployment and poverty of any municipality in New York State. It was recently selected as the worst city in the United States for retirees (See related story). Many if not most city residents live in subsidized housing or in neighborhoods most people would describe as slums.

Welcome to the world of Paul Dyster. Since the turn of the century, he’s spent four years as the most influential member of the city Council, and nearly nine years as mayor. More than any other living individual, he is responsible for the current state of the city.