By Frank Parlato;

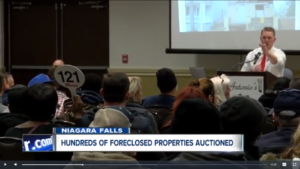

Hundreds of people turned out in Niagara Falls last December to buy homes, buildings, or vacant lots at the city’s tax foreclosure auction.

The city reportedly auctioned off more than 320 properties seized from owners who failed to pay property taxes.

A reliable city hall source tell us the city realized about $1.5 million from the sale.

Niagara Falls has one of the highest property tax rates in the USA, according to the Washington DC Tax Foundation and the NYS Governor’s website. The rate is measure by comparing property values against property taxes.

Niagara Falls is also one of the poorest cities in the USA, according to numerous studies.

In December, as many as 320 people lost their properties. Some were derelict, some were owned by people who gave up on the property and the city. But, there were likely some [as there are at probably every tax foreclosure] who wanted to keep their home but could not afford the taxes and fell behind and then witnessed the city taking their home away and selling it to the highest bidder.

They lost their homes so that Hamister Hotels, Penguin exhibits, empty train stations, free concerts, beer parties at the NAAC, and grants to revolving door businesses on Third Street can be made possible. No one once said, as far as we know, let’s not give this money, for example, to Hamister, let’s reduce taxes instead. That’s not how they think.

So $1.5 million was realized. Some of that came by bringing pain to some people.

So what is the city going to do with the money?

The ethical thing to do is to use it to reduce taxes, not spend it on grants for the rich and upper middle class campaign donors.

Some might think it a badge of honor that 320 properties were taken from owners and sold at an auction and windfall came to the city.

I look at it oppositely: It is a mark of dishonor that so many can’t pay the taxes here, while we live in a very poor city, with nearly the highest taxes.

Photo from https://www.wkbw.com/news/niagara-falls-auctions-hundreds-of-properties