“If it cost $10 million dollars more to run the city than it did eight years ago, then charge me.”

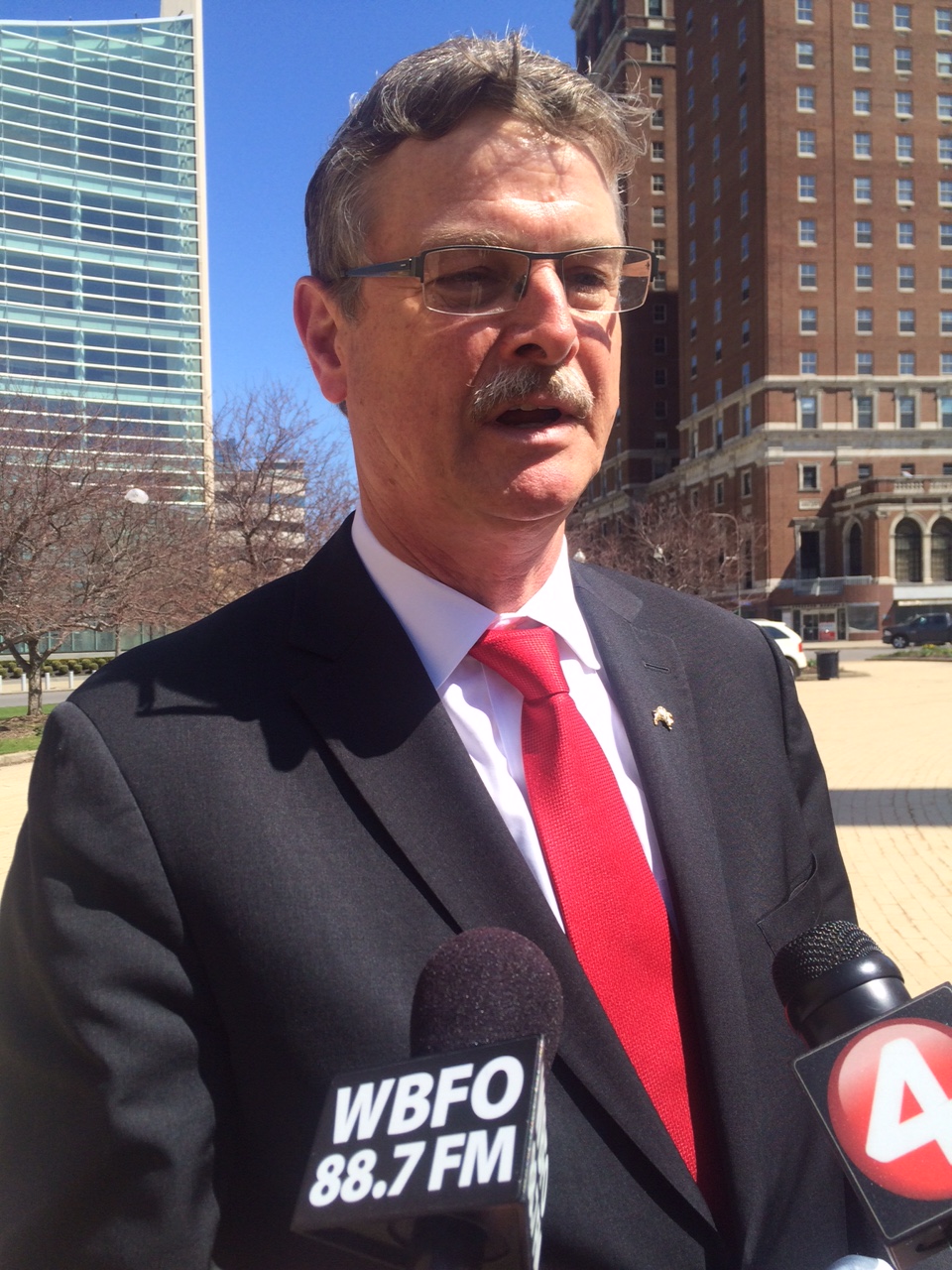

With those words, retired school teacher, former city Council member and a member of the Niagara Falls Financial Advisory Panel, Frank Soda advocated for what would be in effect a 35.7 percent property tax increase for the City of Niagara Falls last week.

Do the math.

The entire amount currently collected by the city in property taxes annually is around $28 million. City expenses have risen by about $10 million a year while property tax revenues have remained the same since Dyster became mayor in 2008.

One of the main reasons property tax revenues are stagnant is not because Dyster has not raised taxes – he has – but because the tax base is shrinking requiring fewer taxpayers to pay the same amount of property taxes that were collected in 2007.

[The city’s population in 2007 was estimated by the US Census Bureau to be about 52,000. Today it is estimated to be 49,000.]

In the past, Dyster has plugged the spending gap with casino cash, which represents 25 percent of the 25 percent of slot machine revenue generated at the Seneca Niagara Casino turned over to Albany each year.

With increased spending, combined with expensive-to-maintain projects such as the North Main Street courthouse and the new train station on Whirlpool Street, plus the fact that casino revenues are dwindling due to increased competition in the gaming industry, either expenses have to be cut, property taxes increased, or Dyster has to continue to use casino cash to plug the deficit.

Making the matter more complicated is that the decrease in casino revenue means plugging the gap, and spending the same amount of casino cash on Dyster-proposed economic development projects, is impossible.

Dyster has suggested cutting casino funding of the Niagara Falls Memorial Medical Center and the Niagara Falls School District which amounts to about $1.5 million per year.

Conversely, Dyster is not proposing cutting the $1.5 million per year casino cash payment to support USA Niagara, a state agency whose general mission is to subsidize [politically connected] developers in downtown Niagara Falls. The $1.5 million donated annually to USA Niagara from casino cash is used by USA Niagara to subsidize a private corporation to operate the conference center and stage events and parties on Old Falls St.

Dyster is also an advocate for funding the Niagara Tourism and Convention Corporation [he sits on the board of directors] with more than one million dollars per year in casino revenue [in addition to another $1 million in bed tax money]. The NTCC has been criticized by this newspaper and others as being too secretive for an intelligent evaluation of their success or lack thereof of their stated goal of “promoting, selling and marketing the county as a premier destination for meetings, conventions and leisure tourism.”

According to figures provided by the state’s Financial Restructuring Board for Local Governments, Niagara Falls is listed as the highest taxed municipality in New York State in proportion to the value of real estate being taxed.

New York State, according to various studies, is one of, if not the highest taxed state in the country. This supports an argument that Niagara Falls, NY is the highest taxed city in America – in proportion to the value of its real estate.

According to the City-data website, the median real estate property taxes paid for housing units with mortgages in 2013 was $2,420. With a $10 million annual increase in property tax revenues –- the tax bill for the average property owner could jump to $3,284.

To achieve the increase in revenue, Council Chairman Andrew Touma and his advisory panel are not proposing an outright tax hike but to “reassess” all business and residential property citywide.

The tax rate would remain roughly the same, but since the property is assessed higher, the property owner pays higher taxes.

Reassessment entails the city assessor making an estimate on every property in accordance with his opinion of market value for that property and changing the assessment accordingly. Council Chairman Touma said he would like to see assessment values brought to 100 percent citywide.

“We’re not where we need to be,” he told the Niagara Gazette. “That’s revenue that the city is losing out on.”

Obviously, Touma’s revenue lost by the city, is taxes not yet paid by property owners. There has been little discussion on cutting expenses.

Dyster has been using casino revenue for years to cover the deficit between tax revenues and expenses. He needed to use $7.6 million in 2014, according to the results of an audit presented by the city’s outside auditing firm. The latest budget required $12.5 million of casino cash.

Yet casino cash has dipped from a high of $21 million a year to about $16 million anticipated this year.

Dyster wants to use what’s left of the dwindling casino revenue for economic development projects [he selects] and wants to follow Touma’s recommendation to raise taxes through a city wide reassessment.

This newspaper has been critical of most of Dyster’s economic development projects as unneeded, as corporate handouts and wasteful. After eight years, little has been accomplished in terms of economic gain for the city.

In our opinion, giving casino money to developers and state agencies is not a better use of money than to keep that money in the hands of the people who live and operate businesses here.

—————–

The men behind the city wide tax reassessment can afford tax increases, so what’s the problem?

Council Chairman Andrew Touma, a teacher on a $105,000 per year salary, plus health insurance and pension benefits, plus $12,000 per year council salary, plus a $10,000 per year health insurance opt out [$127,000], Frank Soda, a retired teacher on a lifetime pension, plus social security, and stipends for service to the Niagara Falls Bridge Commission, and Mayor Paul Dyster, with a $78,000 mayoral salary, plus health insurance and pension benefits and a business in Tonawanda, can likely afford an increase in property taxes to cover the deficit spending of the Dyster administration.

By Niagara Falls standards these men are in the top 1 percent or income.

How about the other 99 percent – seniors on fixed incomes without pensions, workers in the private sector without deluxe government health insurance packages or six figure government salaries? How about landlords whose rents barely cover expenses?

What will they do if the city charges them a pro-rated share of what is needed to pay an additional $10 million per year? Will these pay an extra $50- $100 month in taxes on their newly reassessed property for the cost of a city government that will neither cut expenses nor halt corporate subsidies?

Will rents be raised?; will people move?; will more houses be abandoned? Will some simply stay and suffer and do without something – cheaper food? One less night out per month? Will the end result be not an increase in revenue at all– just less people paying taxes with revenues remaining exactly the same and the deficit continuing?

Should the administration seek ways to cut the budget and halt corporate welfare before proposing a city wide reassessment that will hit beleaguered city taxpayers harder than they are already hit in the highest taxed city in America?