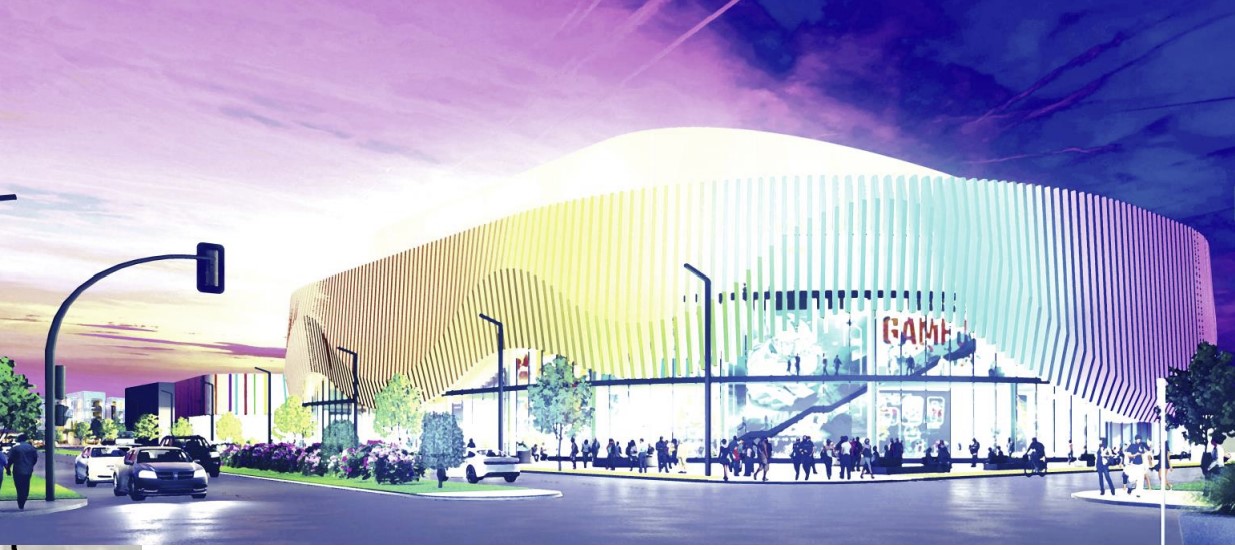

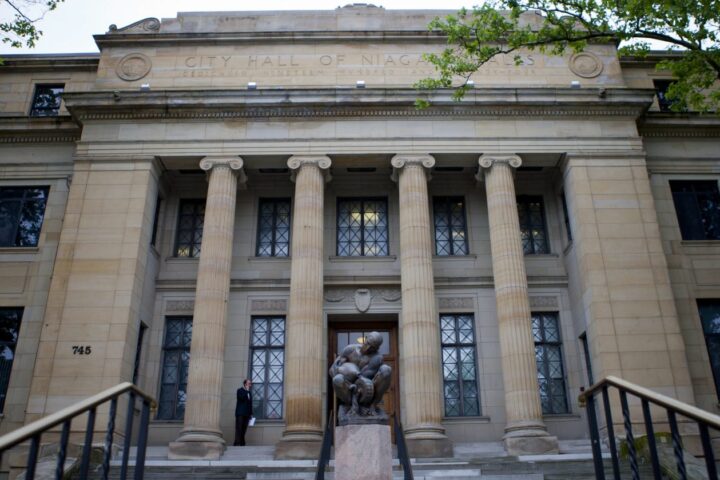

For about five years now, Niagara Falls Mayor Robert Restaino has been pushing his $200 million Centennial Park legacy project—at the expense of looking at potentially much more financially worthy projects like the $1.5 billion data center proposed by NFR—and so far there are no legitimate financial backers for the mayor’s plan even given a new feasibility study that delivers no commercial foundation for success. No commitments to support the project financially from anybody.

The feasibility study is a narrative that delivers more of the same wishful thinking that the mayor has been selling but nothing concrete that investors can realistically bank on. The biggest potential investors right now in the mayor’s plan are Niagara Falls taxpayers who could be on the hook for $200 million in principal and roughly $340 million in lifetime debt service. And of course sprinkle in the hundreds of thousands if not millions in legal fees that have accrued and the cost of acquiring the South End land parcel from NFR and the cost is many, many millions.

Let’s put it this way. The mayor’s plan lacks New York State support which is having financial problems of its own; a verified private investor, and a sustainable operating plan, conditions that make it economically indefensible and politically untenable. And lacks any state support which is having financial problems of its own. In other words, the taxpayers would get killed as things stand now and the return for all that taxpayer investment would be highly speculative and mostly underwhelming. Taxpayers would bear the burden and get mostly empty promises in return. Doesn’t sound like the kind of deal that would give Niagara Falls residents hope for the future, just a further commitment to pay higher taxes for a very, very long time.

Now let’s get down to the nitty gritty, and it is not pleasant if you are a taxpayer facing an uphill climb to nowhere.

The so-called feasibility plan put forward by the administration for Centennial Park fails to meet even the most basic professional standards expected of a legitimate financial or development analysis. It contains no credible site-selection analysis, no comparative market testing, and no verifiable financial modeling of capital costs, operating revenues, or debt-service obligations. With these noteworthy omissions, the plan is rendered functionally meaningless as a financial tool. In other words, pretty much worthless.

To be credible, a feasibility plan must be built on quantitative data. We’re talking about projected attendance, event-mix modeling, per-capital revenue assumptions, construction contingencies, and detailed multi-year operating budgets. None of that data is in the study and instead the plan focuses on youth and amateur sports as the project’s primary economic justification—a market segment that is unreliable at best and unaffordable at worst for sustained operations

A youth or community-focused arena lacks the commercial foundation needed to sustain operations. Typical weekend tournaments generate $40,000–$60.000 in gross receipts, leaving only about $10,000–$15,000 in net facility revenue. Yet annual operating and maintenance cost exceed $4 million to $6 million and debt service on a $200 million facility would add another $11.5 million per year. Centennial Park would recover less than 10 percent of its true costs from event income, requiring permanent—that’s permanent—taxpayer subsidy otherwise the center would never get booked. And taxpayers would have to subsidize youth hockey tournaments. That means subsidizing wealthy hotel owners.

As we’ve written, the feasibility study operates as a political narrative not a business plan. It provides no bankable pathway to construction financing or long-term financial stability and no private investor could treat it as a serious or financial document. Just doesn’t cover the bases.

A project of this magnitude should never proceed without a financially qualified investor providing both up-front capital and multi-year operating assurances. Such a guarantee must be verifiable, bankable, legally enforceable through instruments such as a letter of credit or performance bond. Without this, as we’ve said, the City of Niagara Falls becomes the sole guarantor with taxpayers on the hook for all those millions in debt service and principal.

Should the city issue bonds or co-sign this project without secured private capital, taxpayers will inherit the full risk of the annual debt service of $11.5 million or approximately close to 25 percent of the city’s entire general fund budget. It would mean property taxes could rise between 20 to 30 percent citywide or vital city services would face deep cuts. Once bonded, this obligation cannot be reversed—even if the arena fails or becomes underused. Taxpayers would remain on the hook for three decades of debt payments for a facility that can’t pay for itself.

As for other possible support for the project, like the state which has been frequently mentioned by Restaino, that possibility seems unlikely given the state’s deep fiscal problems. The state comptroller in his August report said New York faces a cumulative budget gap of approximately $34.3 billion through Fiscal Year 2029—one of the worst multi-year shortfalls since the Great Recession. And given the political distance between the state and the Trump Administration, Washington not likely to send a lot of help.

The state’s bonding capacity is strained and despite political sweet talk to Niagara Falls about the Centennial Park project, no money or commitment has followed that talk. There are no written letters of intent from anybody to financially support the Centennial Park project.

After five years of promotion by Restaino, there remains no verified private investor, no signed financing commitment, and no bankable development document, as we’ve said. The public continues to hear vague references to “potential tenants” and “future partners,” but not one credible entity has placed capital at risk or executed a guarantee. This is not how legitimate financing or development is conducted. Every serious arena or entertainment complex begins with binding financial agreements—a bank letter or credit, an investor escrow, or a signed lease from a financially qualified anchor tenant. None exist for Centennial Park.

The mayor—despite all his rhetorical power of persuasion—has failed to secure a single lead tenant or operating partner willing to place their name on a Letter of Intent (LOI), the industry-standard instrument used to demonstrate credible participation and intent. After all these years, there is no anchor tenant, no letter of intent, and no evidence of any party willing to accept financial or operational responsibility for Centennial Park. Apparently, there is no credible commitment of any kind—because there is no credible driver that makes sense of this deal. It is a costly political boondoggle disguised as economic development.

In the present day and in the foreseeable future, despite the “feasibility study” push, the only remaining source of funding is bonded municipal debt—an unacceptable and avoidable outcome given the city’s fragile tax base.

The mayor’s much-hyped legacy project is nothing but a dream project that has no credibility in the eyes of anyone with the ability to expose financial risk with such a slim or no-reward return. The only investors look like the Niagara Falls taxpayers who would pay the price for years for the latest Niagara Falls investment mistake.

There may be opportunities to lift the city to a better future and not on the backs of taxpayers. More failed projects will not turn the tide for a city that desperately needs projects that are fueled by private investment, not taxpayer dollars.

Centennial Park is not a path to a better future, just another path to disappointment that will cost taxpayers for years to come. Let’s hope reality of the situation hits home and the city finds a better way to move forward and not on the backs of the city’s hard-working taxpayers.