Touma Still Pushing for Second Vote On Restructuring Board

By Tony Farina

By just about any measuring stick available, Niagara Falls is a financially distressed city. The evidence is everywhere: decades of population loss, a median income of $31,452, well below the $37,607 for all cities and the state median of $55,603, and a high poverty rate of 17.6 percent compared to 10.8 percent statewide, according to the state comptroller's latest figures.

That being the case, it would seem that Niagara Falls should jump at the chance to work with Gov. Andrew Cuomo's newly created Financial Restructuring Board for Local Governments which was established to help distressed cities. But so far, anyway, city lawmakers have said no to accepting recommendations and possibly loans and/or grants from the new board.

But new Councilman Andrew Touma, as we reported last month, is trying to get his fellow lawmakers to reconsider their 5-0 vote last December against working with the Restructuring Board as recommend by Mayor Paul Dyster.

There are signs that Touma may be making some progress in his efforts to change some minds among the four holdover incumbents who voted against seeking the state board's assistance.

Among those lawmakers who may be willing to take a second look is respected veteran Councilmember Bob Anderson.

Touma has been talking to Anderson about the possibility of reconsidering his no vote, and Anderson now says, in a statement to the Niagara Falls Reporter, that he is studying the issue and has not made up his mind. Here is part of what Anderson had to say:

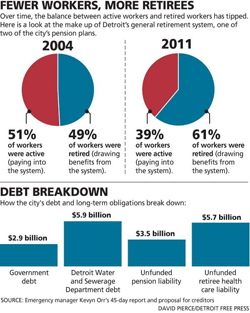

"I think it [the Restructuring Board] is kind of political. But the time may have come when we need to look at it closely. I suspect that if we didn't have a casino in this town, we would have been another Detroit." Anderson's last point is a clear reference to Detroit's "plan of adjustment," the technical term for what it can pay its creditors under its bankruptcy plan.

Now some members of the Niagara Falls Council have expressed concerns about the board being a way to weaken city unions, but Touma insists that is not the case and the city would not be hostage to a take-it-or-leave-it position in working with the Restructuring Board which, he emphasizes, is not a control board, and both sides would have to agree to allow the board to act as an alternative arbitration panel for binding arbitration.

And it could get a lot worse for union members if what is happening in Detroit were to happen in Niagara Falls, and pensioners would have to fight for every dime in bankruptcy court. Maybe there is a windfall coming to Niagara Falls that will turn around the city's financial situation, but so far that windfall is not in sight. The population decline continues and the poverty rate is not going down.

It may take more than Touma's efforts to convince former Council Chairman Glenn Choolokian to change his mind, but Touma plans on continuing to talk to all his colleagues about the potential assistance that the Restructuring Board could provide at no cost to the city.

The City of Rochester is now working with the board, one of six distressed municipalities across the state that have made that decision. A determined Touma is hoping Niagara Falls will become the seventh municipality to take advantage of the opportunity to get some help dealing with the severe financial challenges it faces.

The Financial Restructuring BoardThe program, initiated by Gov. Andrew Cuomo, features a 10-member review board that makes budget cutting recommendations for cities, towns, villages and counties that enter the program. There is no obligation to accept the recommendations unless the municipality accepts what could be up to $5 million in grants or loans from the Financial Restructuring Board (FRB). |

|

In Detroit, which may serve as the model for a future Niagara Falls, the people who live there cannot afford the government and its $18 billion debt, unfunded pension and health care liabilities. Detroit's bankruptcy plan offered pensioners 16 cents on the dollar. In Niagara Falls, like many other cities headed for bankruptcy, and repudiation of pensions and health care benefits for retirees, there is no appetite to cut expenses. |

|

The FRB was designed to aid cities like Niagara Falls, Syracuse, Rochester and Buffalo, upstate cities that have rising retirement costs, falling populations and declining property values. Their goal is to avoid a state control board where, when a municipality can't pay its bills, the state takes over and an appointed board, not subject to the electoral process, imposes cost cuts, refinances debt and freezes wages. |